Save effortlessly with Goals

A down payment, nest egg, or brighter future—own your savings journey with the Goals account. You decide your target savings and timeline. We’ll help you stay on track.

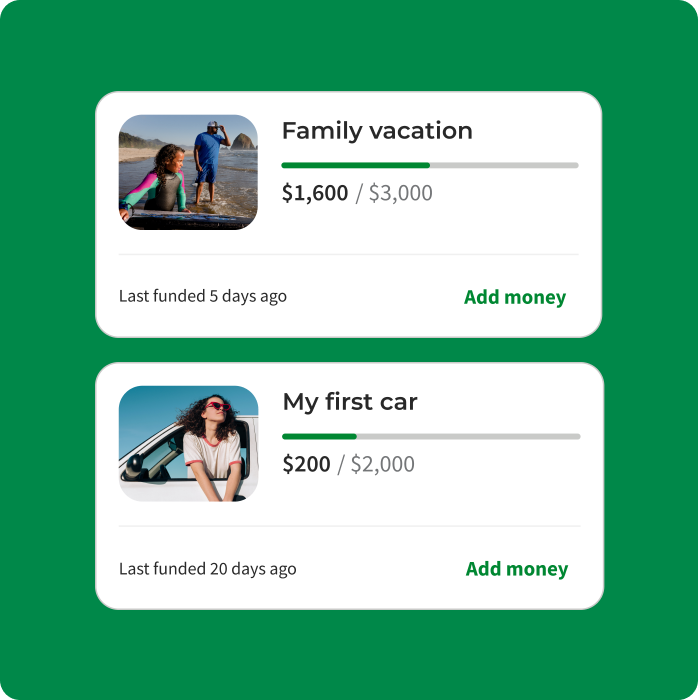

Make savings personal

Behind every Goal is a story, and we help you tell it. When you create a Goal, you’ll name exactly what you’re saving for. It’s a research-backed way to stay motivated.

Skip the fees

You don’t have to worry about hidden fees, minimum deposits, or commitment. It’s your money, you can take it out when you need it.

How to start a Goal

1

Create it

Tell us what you’re saving for, how much you want to save, and what date you want to reach it by.

2

Fund it

Save at your own pace with one-time transfers, or set up recurring deposits to hit your Goal faster.

3

Reach it

Track your progress toward the finish line. We’ll help you celebrate the milestones you hit along the way.

Save while you spend

Have a Dave Checking account? When you turn on the Round Up feature, we’ll automatically round up your Checking purchases to the nearest dollar and save the change in your Goal of choice.

Let’s hit those Goals

Start saving for your next big milestone with no minimums or commitment.

Got questions?

Our team’s got answers.